Among the measure announced in today's Autumn statement were a number of measures that impact local businesses and residents on the Yorkshire Coast.

The minimum wage will rise by 6.7% to £12.21 an hour for people aged 21 and over. This is the equivalent of £1,400 a year for a full-time worker. Workers aged 18 to 20 will see their minimum wage increase by 16.3% to £10 an hour.

National insurance (NI) contributions for employers (not employees) will increase by 1.2 percentage points to 15% from April 2025.

The point at which employers start paying NI will fall from £9,100 a year to £5,000 a year. This will raise £25bn per year.

An increase in employment allowance from £5,000 to £10,000 will mean 65,000 businesses won't pay any national insurance at all next year. It will also mean more than a million businesses will pay the same or less than they did previously.

The Chancellor also announced changes to business rates for businesses in the retail, tourism and hospitality sectors.

Business rates relief will fall from the current 75% down to 45% for retail, leisure, and hospitality businesses.

The Chancellor also announced measure to to tackle increasing levels of shoplifting.

There was also a slight reduction in the tax on draft beer sold in pubs.

The price of soft drinks will rise in line with inflation, with an increase in the drinks levy. Nearly £1bn a year will be raised through the measure.

Extra money was announced for local government, including funding for social care and to tackle rough sleeping.

Measures were also announced to enable greater reinvestment in social housing.

The chancellor also confirmed funding for the upgrading of some rail lines in Yorkshire delivering upgraded serves between York and Manchester.

People will now still be able to claim carers allowance while earning more than £10,000 a year (the equivalent of 16 hours work a week). This will mean an extra £81.90 a week for those newly eligible.

A new fair repayment rate will mean Universal Credit claimants who have been accidentally overpaid will only have to pay back 15% of their allowance each month, falling from 25%. This means a gain of around £420 a year for roughly 1.2 million of the poorest households.

Fuel duty will be frozen this year and next, with the existing 5p cut maintained.

The tax on tobacco will rise at the rate of inflation plus an additional 2%. There will also be an extra 10% on rolling tobacco.

There will be a new flat rate duty on all vaping liquid of £2.20 per 10ml from October 2026.

The freeze on inheritance tax will continue for a further two years until 2030. This means the first £325,000 can be inherited tax-free, rising to £500,000 if the estate is passed to direct descendants, and £1m if it's passed to a surviving spouse or civil partner.

The lower rate of capital gains tax (CGT) on the sale of assets will increase from 10% to 18%. The higher rate will go from 18% to 24%. CGT on the sale of residential property will also increase from 18% to 24%.

From tomorrow, the stamp duty surcharge for second homes, or 'higher rate for additional dwellings', will increase by two percentage points to 5%.

Health and employment services for people who are disabled and long-term sick will get £240m in funding.

The household support fund will receive £1bn to help those in financial hardship with the cost of essentials.

The day-to-day NHS budget will increase by £22.6bn. There will also be a further £3.1bn investment in its capital budget for facilities and equipment. This will facilitate 40,000 extra hospital appointments and procedures every week and will include £1.5bn for new hospital beds.

Some 500 old state schools that are not fit for purpose will be rebuilt at a total cost of £1.4bn. There will be an extra £300m for school maintenance each year, which will cover dealing with concerns about reinforced aerated autoclaved concrete (RAAC).

The budget for free school breakfast clubs will be tripled to £30m in 2025 and 2026. The core budget for schools will also rise by £2.3bn.

There will also be an investment of £300m for further education and £1bn for children with special educational needs (SEN).

All government departments will have to reduce their budgets by 2% next year. This will be achieved by "using technology more effectively and joining up services across government".

Injured Yorkshire Coast Seal Back in the Water

Injured Yorkshire Coast Seal Back in the Water

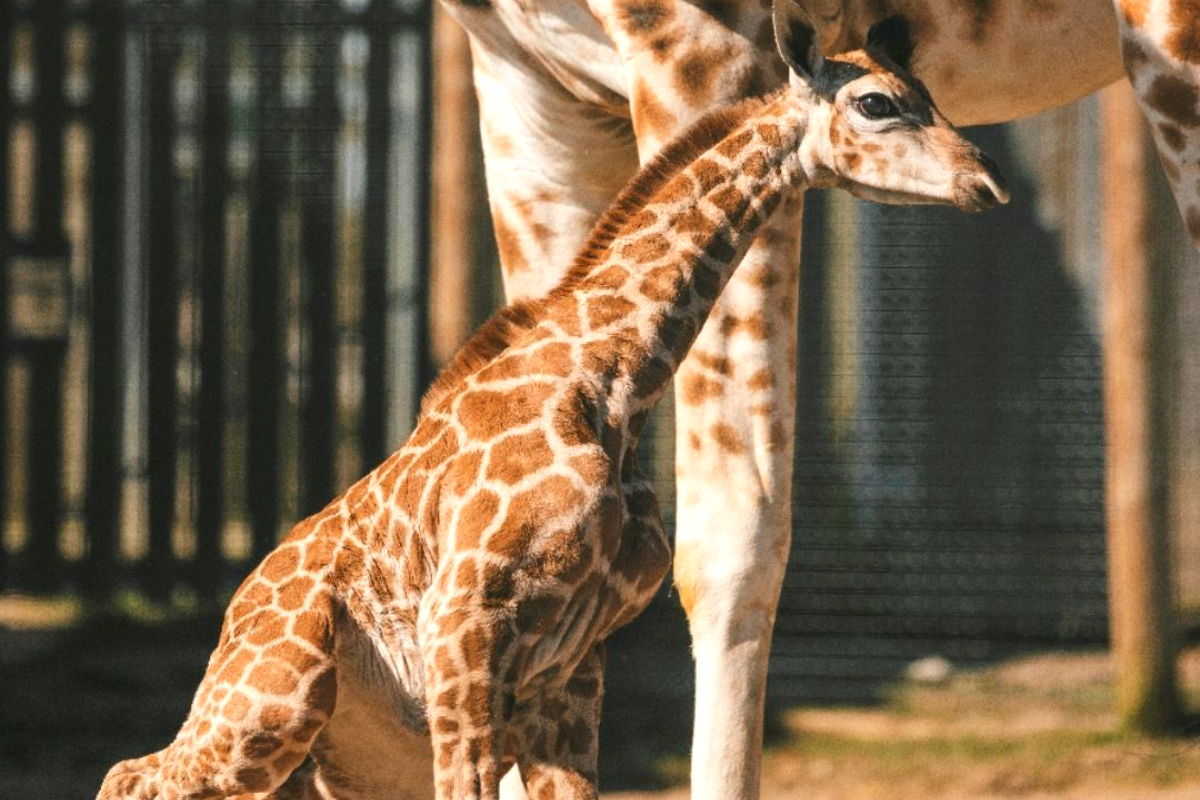

Flamingo Land Welcomes Baby Giraffe

Flamingo Land Welcomes Baby Giraffe

Scarborough and Whitby MP to Launch Petition for Return of Stroke Services

Scarborough and Whitby MP to Launch Petition for Return of Stroke Services

UK Mayors Being Urged to Buy Scarborough Buses

UK Mayors Being Urged to Buy Scarborough Buses

Free Music Events in Scarborough to Raise Funds for Andy's Man Club

Free Music Events in Scarborough to Raise Funds for Andy's Man Club

Scarborough's Cross Lane Hospital Receives Heartfelt Gift

Scarborough's Cross Lane Hospital Receives Heartfelt Gift

Saint Catherine’s Becomes First UK Hospice to Launch Masonic Aware Initiative

Saint Catherine’s Becomes First UK Hospice to Launch Masonic Aware Initiative

Candidates Confirmed for First Scarborough Town Council Elections

Candidates Confirmed for First Scarborough Town Council Elections

Scarborough Station Set for Multi-Million-Pound Roof Renovation

Scarborough Station Set for Multi-Million-Pound Roof Renovation

Renewed Appeal Following "Shocking" Arson in Whitby

Renewed Appeal Following "Shocking" Arson in Whitby

Six Candidates Standing to Become First Elected Mayor of Hull and East Yorkshire

Six Candidates Standing to Become First Elected Mayor of Hull and East Yorkshire

Construction to Start on Whitby Maritime Hub

Construction to Start on Whitby Maritime Hub

Comments

Add a comment