Scarborough's new town council, looks set to have a budget of £384,000 a year resulting in a additional Band D council tax charge of £28.88 per year.

That figure is lower than the North Yorkshire Average of £96 but some local councillors are concerned that it's still too much.

Councillor Rich Maw worries that the new council won't be seen to deliver value for money.

The new town council will be created next spring, its first year budget will be set by North Yorkshire Council and how much that should be has sparked debate amongst the town's Charter Trustees, who are responsible for providing feedback to North Yorkshire Council.

The proposed budget includes provisions for:

- Key Staff: £115,000 has been allocated for a full-time town clerk and administrative support.

- Minimum Running Costs: £58,000 is earmarked for essential operational expenses such as premises, insurance, audit fees, and legal support.

- Civic Duties and Events: £15,000 will be dedicated to supporting the council's civic responsibilities and events.

- Set Up Costs: £46,000 is allocated to cover initial expenditures like interim clerk fees, equipment purchases, and website development.

- Contingency Funds: £150,000 is proposed for contingencies, split into £100,000 for risk mitigation and £50,000 for service development.

The inclusion of a £100,000 "risk mitigation contingency" has been a particular point of discussion. Some Charter Trustees believe this amount is excessive and could be reduced to lower the precept, advocating for the exploration of alternative funding options like loans to manage potential risks. Conversely, other trustees support the contingency, arguing that a robust reserve fund is crucial for the new council's autonomy and ability to undertake ambitious projects without relying on North Yorkshire Council.

Councillor Rich Maw wanted to see a lower budget and lower council tax precept, but other local councillors, including Liz Colling, voted to support the funding plan.

The proposed budget would translate to a Band D council tax charge of £28.88 for residents within the Scarborough Town Council area. This figure falls within the spectrum of charges observed in other North Yorkshire towns, which average £94, ranging from approximately £27 in Knaresborough to £129 in Selby.

The Charter Trustees voted to back the proposed budget. North Yorkshire Council will make a final decision at a meeting on 13 November 2024.

Scarborough Athletic Fans, Finance Director and Manager Speak of Emotional Week at the Club

Scarborough Athletic Fans, Finance Director and Manager Speak of Emotional Week at the Club

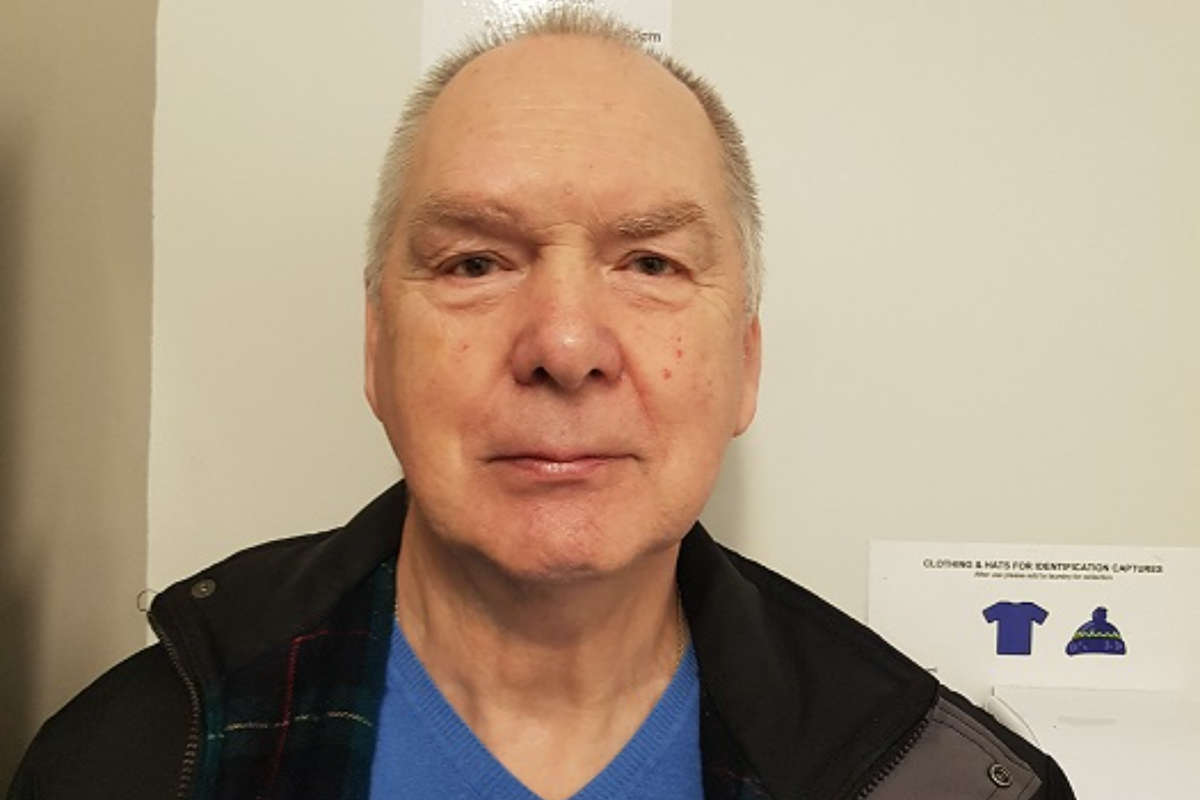

Police Release E-Fit After East Riding Assault

Police Release E-Fit After East Riding Assault

Filey Food & Drink Festival Weekend

Filey Food & Drink Festival Weekend

Whitby Town On Verge of Safety After Thriller

Whitby Town On Verge of Safety After Thriller

Scarborough Athletic Leave It Late in County Durham

Scarborough Athletic Leave It Late in County Durham

Key Weekend in Bridlington Town's Relegation Battle

Key Weekend in Bridlington Town's Relegation Battle

Tour of Britain Cycle Event for Dalby Forest

Tour of Britain Cycle Event for Dalby Forest

Look Out For Bridlington Lifeboat's Pirates On The Promenade

Look Out For Bridlington Lifeboat's Pirates On The Promenade

Chaser Returns to Scarborough for Panto Season

Chaser Returns to Scarborough for Panto Season

Scarborough Athletic Pitch Could be Out of Action for 44 Weeks And Cost £3m to Repair

Scarborough Athletic Pitch Could be Out of Action for 44 Weeks And Cost £3m to Repair

North Yorkshire Police Report Significant Improvement in Call Answer Times

North Yorkshire Police Report Significant Improvement in Call Answer Times

Ryedale Sex Offender Confronted By Angry Mother

Ryedale Sex Offender Confronted By Angry Mother

Comments

Add a comment