Kevin Hollinrake wants to replace business rates with an increase in VAT

Filey MP, Kevin Hollinrake, has introduced a Ten Minute Rule Bill in the House of Commons which would bring an end to business rates and replace the revenue with a small increase in VAT.

Mr Hollinrake said this would create a much needed level playing field between online and high street retailers and could help save hundreds of thousands of businesses and jobs impacted by the slump in sales because of the health crisis.

Mr Hollinrake told the Commons that business rates were designed for a bygone era when business went hand in hand with high street premises but the way we shop is now changing for ever. Since the pandemic and because we have spent long periods in lockdown online sales now account for 33% of all retail sales compared to 20% only a year ago.

In July Treasury ministers undertook a review and call for evidence into business rates. Mr Hollinrake who described his Bill as a contribution to the debate said

“In my view, the best option would be to completely scrap business rates and apply a small increase in the sales tax that already exists in the shape of VAT. This would immediately level the playing field, would not create any additional bureaucracy and we would be able to completely dispense with the convoluted business rates system including revaluations, check, challenge, appeal, annual bills and debt collection. It would also liberate thousands of talented, intelligent hard-working people in the Valuation Office Agency and survey practices to find new career opportunities that would drive forward the UK economy”.

Mr Hollinrake said an additional benefit would be that we would no longer need the myriad of reliefs available to small business, charities, empty properties retail and rural as VAT would automatically adjust depending on business type and turnover. The MP, who has spent a lifetime in business, also suggested reducing the VAT threshold which is currently at £85,000 to the German level of £20,000 because the current level disincentives growth and incentivises tax evasion.

Mr Hollinrake estimated that an increase in VAT from 20p to 23p would fill the £30bn per annum gap created from business rates abolition whilst levelling the playing field between online and high street businesses.

Injured Yorkshire Coast Seal Back in the Water

Injured Yorkshire Coast Seal Back in the Water

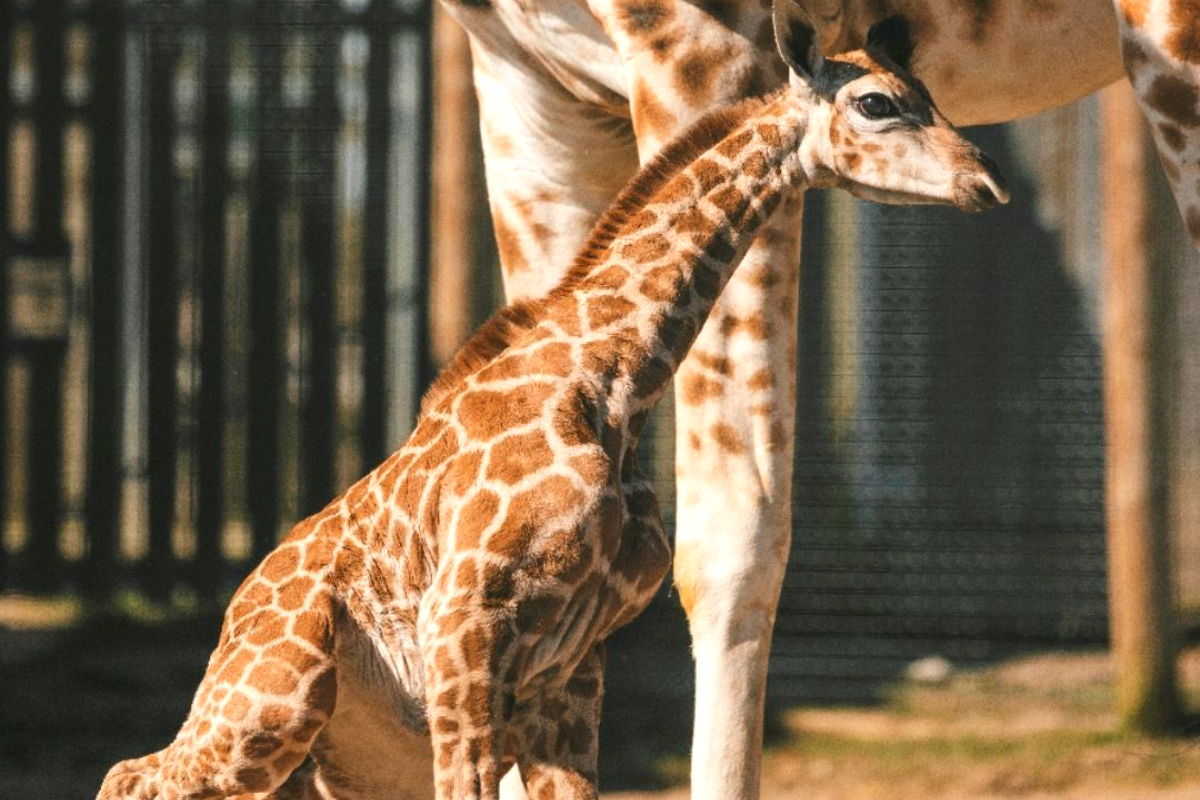

Flamingo Land Welcomes Baby Giraffe

Flamingo Land Welcomes Baby Giraffe

Scarborough and Whitby MP to Launch Petition for Return of Stroke Services

Scarborough and Whitby MP to Launch Petition for Return of Stroke Services

UK Mayors Being Urged to Buy Scarborough Buses

UK Mayors Being Urged to Buy Scarborough Buses

Free Music Events in Scarborough to Raise Funds for Andy's Man Club

Free Music Events in Scarborough to Raise Funds for Andy's Man Club

Scarborough's Cross Lane Hospital Receives Heartfelt Gift

Scarborough's Cross Lane Hospital Receives Heartfelt Gift

Saint Catherine’s Becomes First UK Hospice to Launch Masonic Aware Initiative

Saint Catherine’s Becomes First UK Hospice to Launch Masonic Aware Initiative

Candidates Confirmed for First Scarborough Town Council Elections

Candidates Confirmed for First Scarborough Town Council Elections

Scarborough Station Set for Multi-Million-Pound Roof Renovation

Scarborough Station Set for Multi-Million-Pound Roof Renovation

Renewed Appeal Following "Shocking" Arson in Whitby

Renewed Appeal Following "Shocking" Arson in Whitby

Six Candidates Standing to Become First Elected Mayor of Hull and East Yorkshire

Six Candidates Standing to Become First Elected Mayor of Hull and East Yorkshire

Construction to Start on Whitby Maritime Hub

Construction to Start on Whitby Maritime Hub

Comments

Add a comment