East Riding Council is studying ways to get April’s £150 tax rebate to the tends of thousands locals it does not hold bank details for.

An East Riding Council spokesperson said County Hall officials were working to find the most effective and efficient means of getting the rebate to those without a direct debit.

The spokesperson added affected locals would be informed once more details on a scheme to get the money to them has been drawn up.

It comes as questions have been raised as to how the £150 council tax rebate would be paid to those who do not use direct debits.

Councils plan to pay the rebate, unveiled by Chancellor Rishi Sunak earlier this month, to locals directly into their bank accounts.

But East Riding Council’s spokesperson told LDRS they do not have direct debit details for some 30,000 locals who pay council tax by other means.

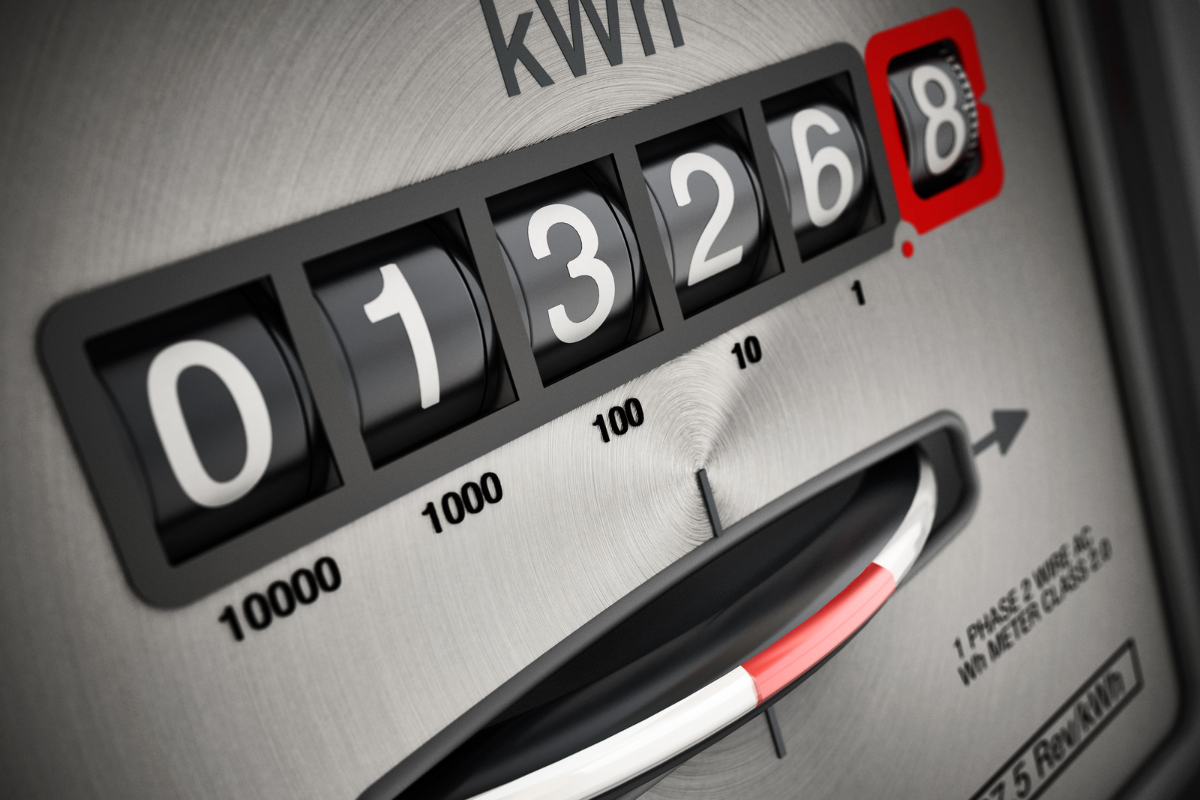

It follows Mr Sunak’s announcement that households will receive £150 in April to ease the blow of rocketing energy bills.

The chancellor unveiled the rebate alongside a £200 discount on energy bills, to be paid back in £40 instalments over five years from 2023.

Council tax Band A to D households are eligible for the rebate, meaning 99 per cent of Hull homes and 83 per cent in the East Riding will get it.

Mr Sunak said the payments and discounts were designed to address the number one issue on people’s minds, the rising cost of living.

The chancellor said:

“The Government is stepping in with direct support that will help around 28m households with their rising energy costs over the next year.

“We stood behind British people and businesses throughout the pandemic and it’s right we continue to do that as our economy recovers in the months ahead.”

East Riding Council’s spokesperson said it received guidance from the Government on Wednesday, February 23 setting out the verification process for the rebates and how to stop fraud.

The spokesperson said:

“The guidance also provided some options around how we may pay those without a direct debit account, across the East Riding this is estimated to be around 30,000 council tax accounts.

“We are still working through the detailed guidance with the hope that we can find a method which is both efficient and effective for our residents and the council.

“We will update our website and will advise residents as soon as we have more information.”

Whitby Should Not Become "Las Vegas of the East Coast"

Whitby Should Not Become "Las Vegas of the East Coast"

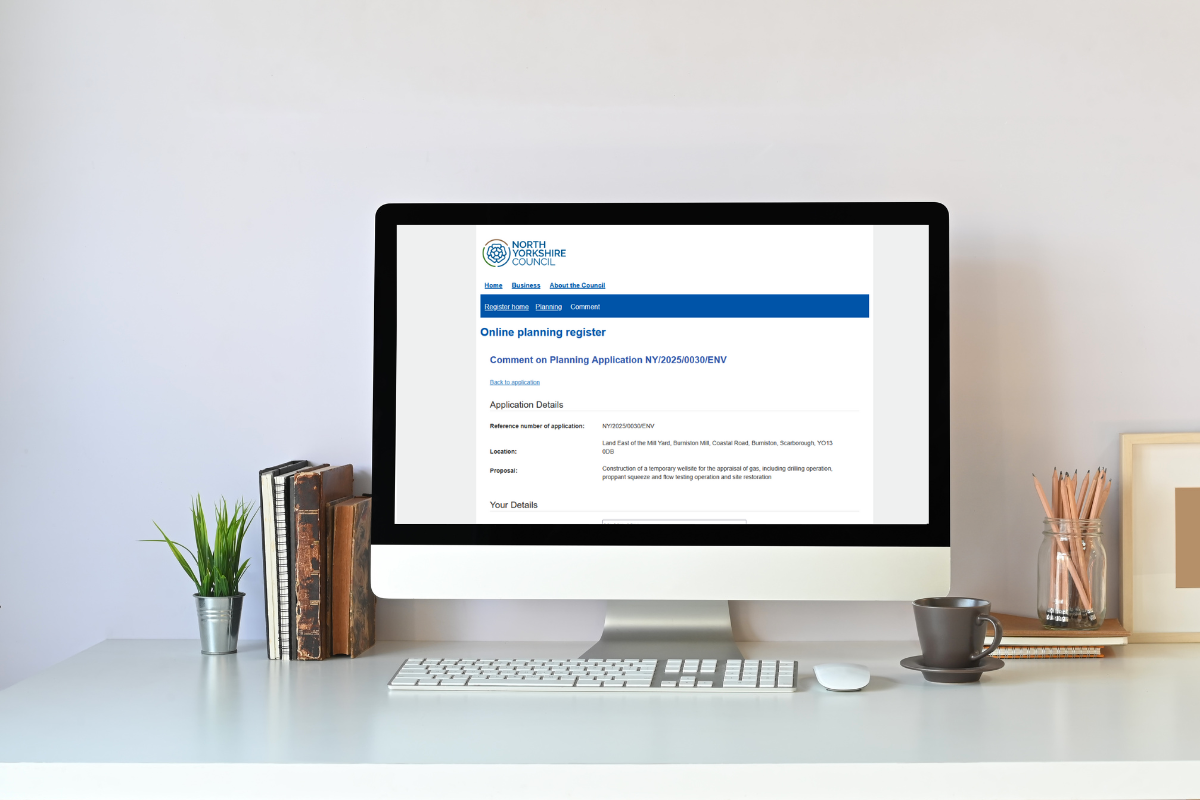

Residents Report Issues Commenting on Burniston Fracking Well Application

Residents Report Issues Commenting on Burniston Fracking Well Application

‘Vital’ School Holiday Programme to Continue for Another Year

‘Vital’ School Holiday Programme to Continue for Another Year

Hundreds Take up Offer of Workplace Health Checks in East Yorkshire

Hundreds Take up Offer of Workplace Health Checks in East Yorkshire

Whitby Adult Gaming Centre Plan Rejected

Whitby Adult Gaming Centre Plan Rejected

Police Granted Extra Time to Question Man Arrested Over Yorkshire Coast Ship Collision

Police Granted Extra Time to Question Man Arrested Over Yorkshire Coast Ship Collision

New North Yorkshire Autism Strategy Aims to Improve Assessment Process

New North Yorkshire Autism Strategy Aims to Improve Assessment Process

Bridlington Fishermen Get Water Samples From Close to Yorkshire Coast Tanker Collision

Bridlington Fishermen Get Water Samples From Close to Yorkshire Coast Tanker Collision

East Yorkshire's Potential for Energy Investment Highlighted by Council Leader

East Yorkshire's Potential for Energy Investment Highlighted by Council Leader

Success for Cayton Dance Academy at British Competition

Success for Cayton Dance Academy at British Competition

Bridlington Central Library to Close for Major £449k Refurbishment

Bridlington Central Library to Close for Major £449k Refurbishment

Council Set to Increase Scarborough Housing Stock

Council Set to Increase Scarborough Housing Stock

Comments

Add a comment