Humberside Police are taking part in a national week of action.

Every year, more than 130 people are killed on our country’s roads by uninsured drivers.

This week officers from Humberside Police's Roads Policing Unit will be taking part in a week-long national campaign aimed at reducing the number of uninsured drivers.

Running from Monday 21 November to Sunday 26 November, the operation will see an increased focus on uninsured drivers across East Yorkshire.

Sgt Diane Kemp, from our Roads Policing Unit, said:

“Uninsured drivers cost each taxpayer £53 per year as it is us who have to pay for uninsured incidents.

“We know some motorists have simply forgotten to renew their insurance, but there are many who deliberately drive without insurance – for many reasons. Half of the seized vehicles nationally were driven by people with criminal records and people driving without insurance are ten times more likely to be convicted drink drivers.

“Driving without insurance can have devastating consequences. It is the driver’s responsibly to make sure they are insured, and this includes those driving company vehicles.

“The law is clear on this. All motor vehicles being used on a public highway must meet the minimum insurance requirements.

“If you are caught without insurance, you will face a minimum fine of £300, and you will get at least six points on your licence.

“We will also seize the vehicle and the driver or owner is responsible for the recovery and storage costs. The vehicle won’t be handed back until there is a valid insurance policy in place.

“Even if the vehicle isn’t yours, as the driver you are almost always the one who will be held responsible.

“We of course want to educate motorists in our region, but we will enforce where required.

“If your insurance company has the facility, you can ask to be enrolled into their auto-renewal scheme to make sure you are always covered.

“If you are ever unsure as to whether the vehicle you are driving has insurance, you can check with your insurer, the owner, the gov.uk website, or via the Motor Insurers Bureau website.”

Injured Yorkshire Coast Seal Back in the Water

Injured Yorkshire Coast Seal Back in the Water

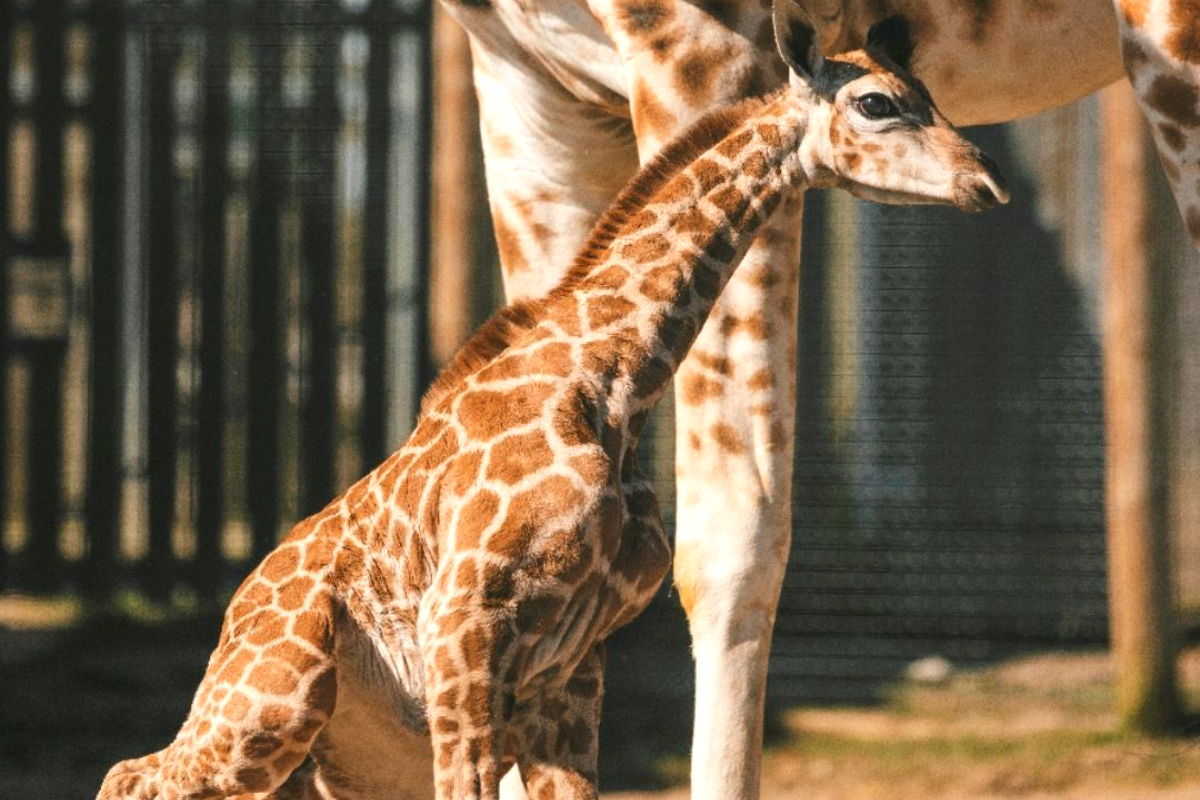

Flamingo Land Welcomes Baby Giraffe

Flamingo Land Welcomes Baby Giraffe

Scarborough and Whitby MP to Launch Petition for Return of Stroke Services

Scarborough and Whitby MP to Launch Petition for Return of Stroke Services

UK Mayors Being Urged to Buy Scarborough Buses

UK Mayors Being Urged to Buy Scarborough Buses

Free Music Events in Scarborough to Raise Funds for Andy's Man Club

Free Music Events in Scarborough to Raise Funds for Andy's Man Club

Scarborough's Cross Lane Hospital Receives Heartfelt Gift

Scarborough's Cross Lane Hospital Receives Heartfelt Gift

Saint Catherine’s Becomes First UK Hospice to Launch Masonic Aware Initiative

Saint Catherine’s Becomes First UK Hospice to Launch Masonic Aware Initiative

Candidates Confirmed for First Scarborough Town Council Elections

Candidates Confirmed for First Scarborough Town Council Elections

Scarborough Station Set for Multi-Million-Pound Roof Renovation

Scarborough Station Set for Multi-Million-Pound Roof Renovation

Renewed Appeal Following "Shocking" Arson in Whitby

Renewed Appeal Following "Shocking" Arson in Whitby

Six Candidates Standing to Become First Elected Mayor of Hull and East Yorkshire

Six Candidates Standing to Become First Elected Mayor of Hull and East Yorkshire

Construction to Start on Whitby Maritime Hub

Construction to Start on Whitby Maritime Hub

Comments

Add a comment